(Image Source: Madison Kaminski / Unsplash)

Wisconsin IDEA

Insight • Data • Economics • Analysis

Wisconsin Ranks 38th Nationally with Positive per Capita Balance of Payments

From a simple economic growth and development perspective, the payment of federal taxes is a leakage from the local or regional economy. As such, these leakages weaken the local or regional economy. One strategy commonly used to address this leakage is to maximize the flow of federal spending back into the local or regional economy. This can be working to ensure that local residents who are eligible for federal programs, such as Social Security or Medicare-Medicaid, are taking full advantage of those programs to working with local companies to secure federal grants/contracts to state and local governments taking full advantage of federal grants and aids programs.

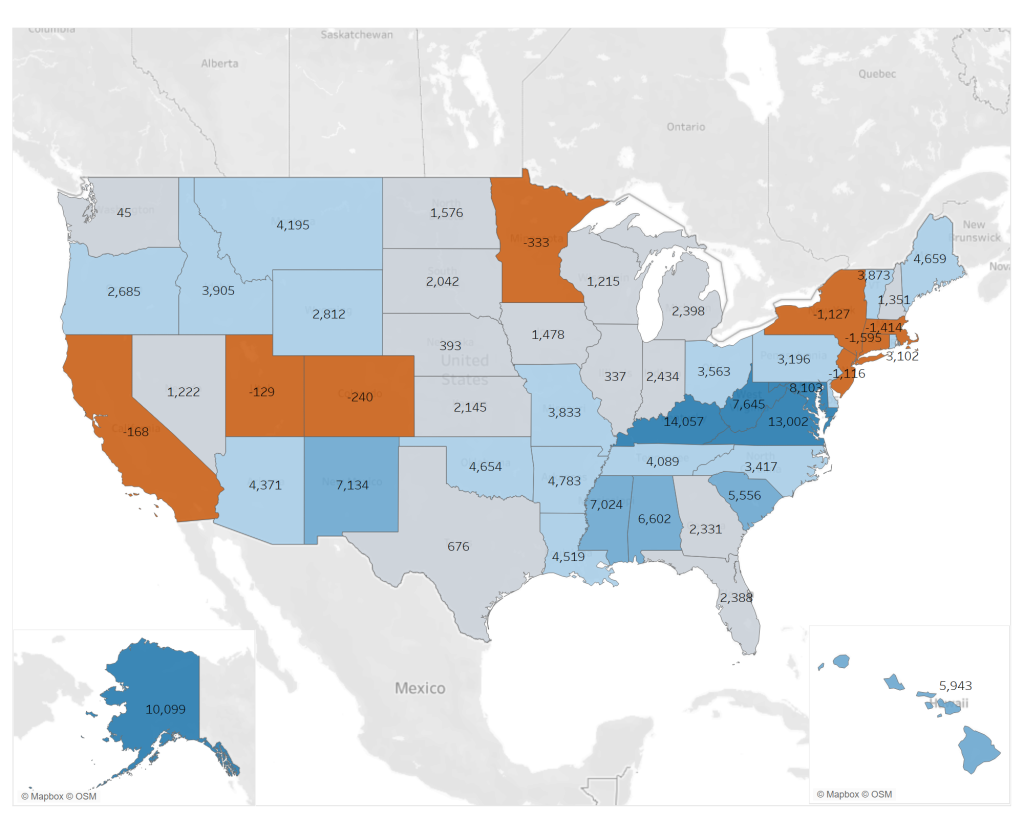

Map 1. State-Federal Government Balance Payments, 2019

Using data for fiscal year 2019 (more current years are atypical because of aggressive COVID related spending by the federal government) the SUNY Rockefeller Institute of Government compute what is referred to as the State-Federal Government Balance of Payments. After adjusting for population as a measure of the size of the state, 42 states had a positive Balance of Payment with the remaining eight having a negative Balance of Payment. The predominance of positive Balance of Payments is largely due to the federal government running deficit budgets where spending is greater than revenues. The states with the largest positive Balance of Payments tend to have high concentrations of poverty where federal taxes tend to be low and federal support payments high (e.g., New Mexico, Mississippi, Alabama) and/or large military presence (e.g., Virginia). The latter can be military bases or large defense contractors with significant Department of Defense contracts. Some states, such as Kentucky, have federal officials that are effective in securing federal resources for their state. The states that have negative Balance of Payments tend to be high income states (e.g., Connecticut, Massachusetts, New York, California) where the flow of federal support programs aimed at addressing low income individuals is modest.

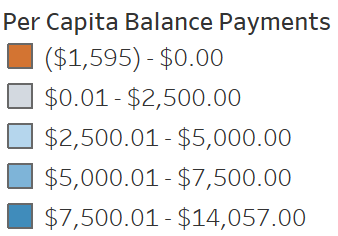

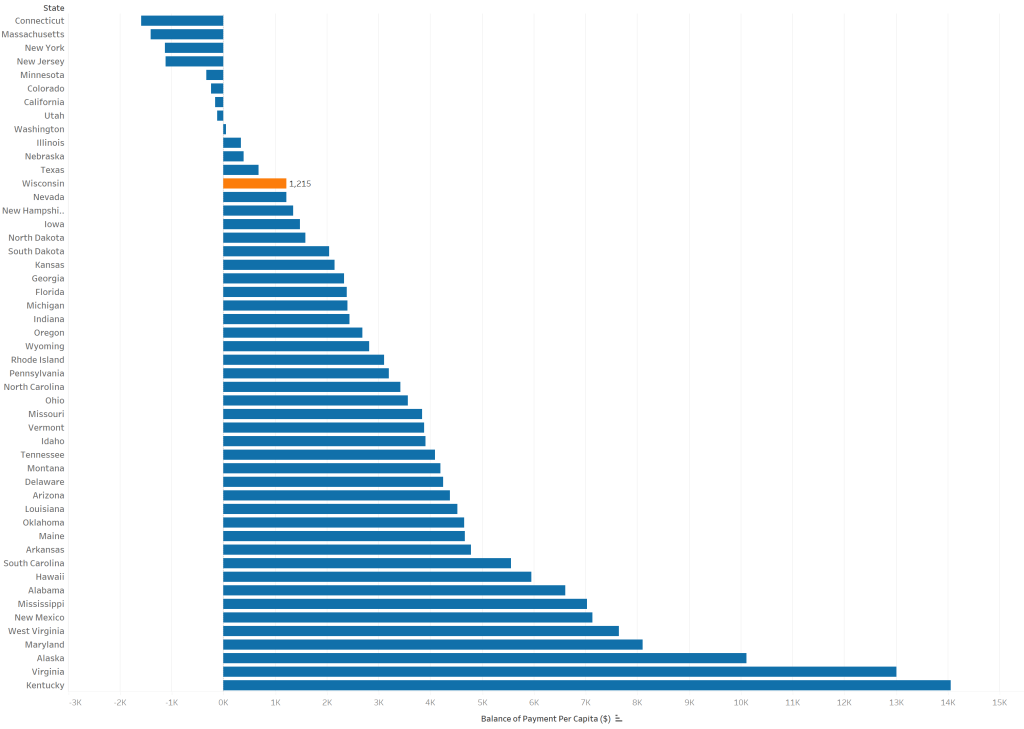

Figure 1. State-Federal Government Balance Payments Per Capita, 2019

Wisconsin ranks 38th nationally with a positive per capita Balance of Payment of $1,215, or $7.15 million. For every dollar flowing to the federal government in the form of taxes $1.13 returns to Wisconsin. Strategies that could be pursued to maximize the Balance of Payment to Wisconsin is to work with individuals and families to ensure that they are taking full advantage of federal support programs. For example, work with veterans groups to maximize the flow of veterans benefits flowing into the state. Work with Wisconsin businesses to monitor and compete for federal contracts including but not limited to the Department of Defense. Provide resources to make institutions of higher education, such as the University of Wisconsin, to be more competitive for federal research and development grants.